Don't miss the chance to work with top 1% of developers.

Sign Up Now and Get FREE CTO-level Consultation.

Confused about your business model?

Request a FREE Business Plan.

Facebook’s CryptoCurrency Libra: What Is It and How Is It Different from Bitcoin?

Table of contents

The giant that gave birth to the era of social media is now all set to rock our finances.

Yes, we are talking about Facebook and its new born child Libra. Let’s dig in and find everything about Facebook’s CryptoCurrency Libra!

On June 18, 2019, Facebook’s CEO and co-founder, Mark Zuckerberg, announced its plans to launch its own digital cryptocurrency called Libra in the year 2020. Facebook has been working on developing Libra for over a year now and it really made it big. The support it received from some of the most famous brands in finances, technology and retail market is the proof.

The new innovation threatens to change the scenes of banking and is as of now the subject of scrutiny. The objective of Facebook behind developing Libra with a consortium of 27 partners is to make a new global currency and the foundation for a new universe of financial services.

While that’s said as per the Facebook’s whitepaper, let us see what exactly is Libra and what will you be able to do with it – only if things go in favor of this new innovation. Here are the answers to the big questions that might come to mind while thinking about Libra, its benefits and consequences.

What is Facebook’s CryptoCurrency Libra and How Will It Work?

As per Facebook, Libra is a “digital currency based on blockchain technology.” In other words, it is a digital resource developed by Facebook and fueled by another Facebook-created form of blockchain.

The aim of Libra is to become an easy global currency and budgetary infrastructure that will empower billions of individuals. Libra is comprised of three parts that will work together to make it an increasingly inclusive financial framework:

- It is developed on a scalable, secure and reliable blockchain;

- It is governed by a reserve of assets intended to provide it intrinsic value;

- It is administered by the independent Libra Association entrusted with developing the Libra ecosystem.

The above points imply that Libra isn’t only a Facebook-backed cryptographic money. It is supported by a reserve of genuine assets, including bank deposits and short-term government protections. You can discover the establishing partners of the Libra Association, which will manage the design, release and maintenance of the currency in the picture underneath:

The organizations who contributed a minimum $10M to be listed as establishing members of the Libra Association incorporate tech organizations, like, Ebay, Paypal, Spotify, Lyft, Uber and venture capital and financial firms, like, Thrive Capital, Andreessen Horowitz, Visa and Mastercard.

This further implies that it is expected to be a stable release and we won’t see wild swings in its value as we saw with Bitcoin.

Now that we know what exactly is Facebook’s CryptoCurrency Libra, let’s move forward and see how will it work.

Also Read: How Is Blockchain Technology Revolutionizing Mobile Apps?

How Will Libra Work and How Can You Use It: Introduction to Calibra

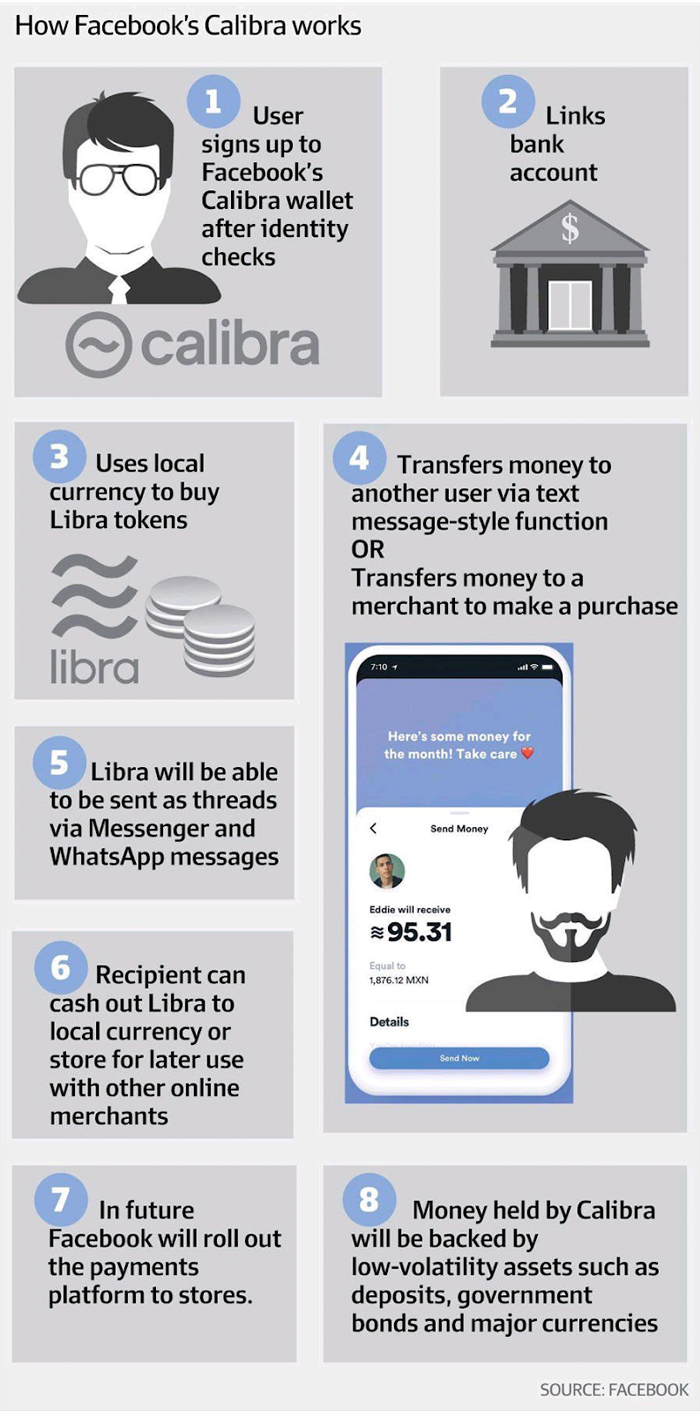

Facebook knows that people would prefer not to blend their financial information with other personal data, like the posts they update to their FB profile. So, Facebook made another auxiliary, Calibra, that will build and keep up the organization’s digital wallets and work on the Libra cryptocurrency .

In spite of the fact that Libra is planned to be traded by means of various platforms, Calibra will remain the major one. Here is all you need to know about Calibra:

The Calibra wallet will exist as an independent application, but will also have integration with Facebook Messenger and WhatsApp, enabling users to send and receive Libra currency directly inside the messaging platform similarly as they would text.

Let’s see how Facebook’s calibra will work:

A Facebook account won’t be required to have a Calibra wallet, either; the organization intends to offer the wallet for free. Facebook also said it won’t have access to user’s financial information, which will be overseen by Calibra only. Thusly, public transactions won’t be tied to user’s personalities so that data can’t be utilized for promotional ads targeting.

If Libra functions as proposed, once users own Libra, they will have the option to send them to any other business or individual with a Libra wallet, at anyplace on the planet.

If you need to turn Libra once more into dollars or other conventional currencies, Facebook’s wallet, Calibra, will make the transformation possible — based on the present value of the underlying currencies — and transfer the money to another bank or online account like PayPal.

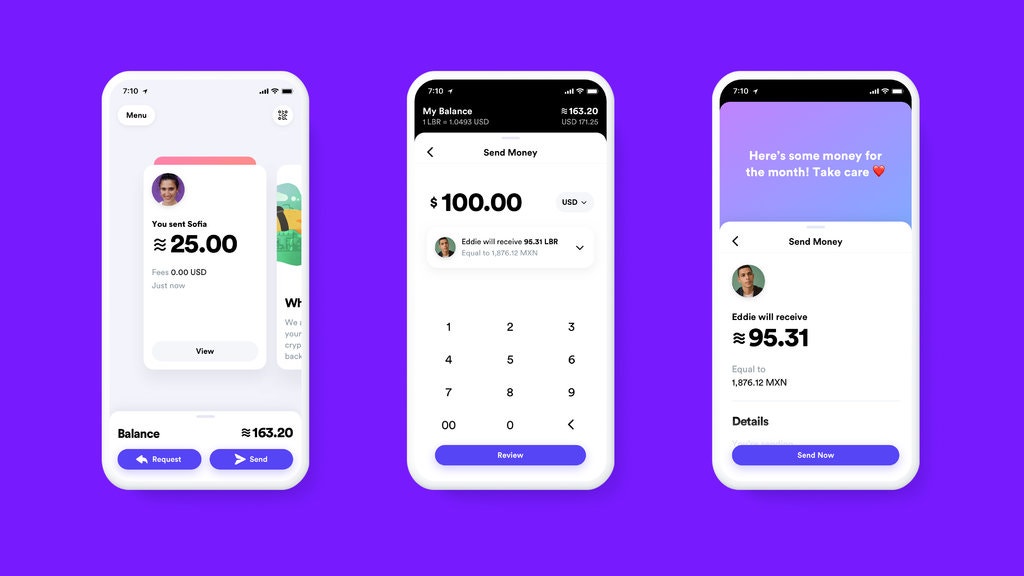

Here is a proposed look of a Calibra mobile app:

Ultimately, the objective of Facebook’s digital currency coin is to make a universal Libra payment framework that can allow transactions rapidly around the globe, while not charging a transactional fee.

At present, if you want to send $200 across borders, a 7.1% transaction expense is charged. Facebook’s CryptoCurrency Libra will connect this hole and will serve the globe with affordable financial transactions.

Libra vs Bitcoin: How Is Libra Different From Bitcoin?

Other than the fact that the two of them come with a white paper and are called as cryptocurrencies, Libra and bitcoin have nothing in common. Here’s a list of the key differences between the two:

1. Difference In Technology

The biggest difference between these cryptocurrencies lies in the fundamental technology behind the two. With bitcoin, transactions are recorded secretly on an open ledger known as the blockchain. It’s a database kept up by a network of computers, on which transactions are completely secured and it is almost impossible to tamper or modify them.

Libra also utilizes a type of blockchain, or distributed ledger innovation. Yet, unlike bitcoin, Libra’s blockchain is permissioned (at least for now) implying that transactions can only be added to it by a group of parties that are trusted. It’s distinctive to bitcoin’s system, which can be accessed and kept up by anybody with average enough hardware and access to the internet.

Bitcoin is an open technology and it is not maintained or managed by any bank. You can download a crypto-wallet, or even form your own wallet. You can likewise run your own node, and anybody can send money to anybody. However, that won’t be the scenario with Facebook’s Libra. It is a computerized currency with qualities of fiat currency.

2. Governance

The developers and the crypto-network is responsible for deciding what happens with the bitcoins. If there is something an individual doesn’t care for or has a superior use case, then he/she can hard-fork the code away and make their own coin.

Libra clearly won’t have that sort of model as it is upheld by Uber, Mastercard, and so on. Here, the companies or individuals who purchased the nodes for $10 million each are the ones who will get the opportunity to choose the eventual fate of the currency.

3. Permissionless and Borderless

Bitcoin clients who have their own wallets and private keys can send money to anybody and don’t require consent. However, when it comes to Libra, governments are already aware of it and are beginning to push back. Additionally, Bitcoin does not care where you live and what your identity is, yet Facebook should fall in line. Facebook coin should boycott Iran, North Korea and different nations which are on the sanctions list.

4. Security and Privacy

Hacking a Bitcoin network is almost next to impossible; it is the most secure network on the planet running for over 10 years now. However, despite everything you have to take care of your private keys on a hardware wallet. In the interim, Libra along with its centralized nodes might be powerless against DDoS assaults, individual ID hacks and so on.

Also from a privacy perspective people are finding it hard to trust Facebook. As per Libra white paper, for example, Facebook won’t import contacts or any of your profile data ― yet it will request you do as such.

It likewise states that it won’t share any transaction information back to Facebook, so it won’t be utilized to target people with ads, rank brands in their news feed or help increase Facebook in increasing revenue.

Given Facebook’s history with user data and security, not every person is concerned it will stick to its words. Here are the tweets of some renowned personalities showing the privacy concerns:

Facebook is already too big and too powerful, and it has used that power to exploit users’ data without protecting their privacy. We cannot allow Facebook to run a risky new cryptocurrency out of a Swiss bank account without oversight. https://t.co/IjZOFNai3r

— Sherrod Brown (@SenSherrodBrown) June 18, 2019

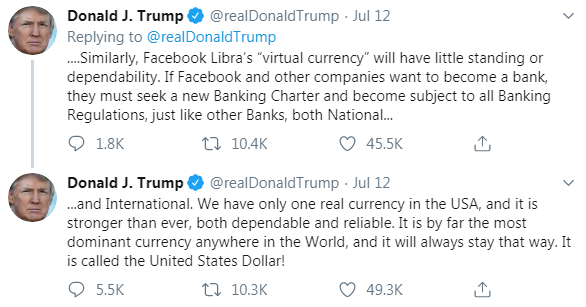

I am not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air. Unregulated Crypto Assets can facilitate unlawful behavior, including drug trade and other illegal activity….

— Donald J. Trump (@realDonaldTrump) July 12, 2019

A few comments made by President Trump on the above tweet shows that he is one of the latest critics of Facebook’s Libra:

Considering Facebook’s earnings is to a great extent reliant on connecting marketers with the correct purchasers, we need to think about what’s ultimately in it for the organization by offering this new assistance.

5. Value proposition

Bitcoin’s value isn’t dependent on any single government. Then again, Facebook’s CryptoCurrency Libra’s value relies upon inflation, government control and changes on primary currencies.

Also Read: How Much It Costs to Make a CryptoCurrency Exchange App Like Coinbase?

What’s There For Blockchain App Developers Along With Libra?

To go along with the package, Facebook has also launched a new programming language called Move written in Rust. The organization claims Move has been developed to “give a safe and programmable foundation for the Libra blockchain.”

As per the official documentation clarifying Libra, Move comes furnished with the vital foundations to make life simpler for blockchain app developers. It provides an advantageous domain wherein designers can without much of a stretch execute their goal with negligible risks of presenting bugs all the while.

The team supervising the project chose to name it Move as its primary job will be to move Libra coins from one account/wallet to another. There are some special preemptive measures inbuilt inside the language that makes it impossible for the coins to be incidentally or noxiously cloned.

Two of Move’s primary tasks include:

- Enabling a smooth and secure execution of the basic governing policies to deal with the Libra ecosystem.

- Secure management of the system

Moreover, when it is completely created, Move will empower engineers to build smart contracts on the Libra blockchain. Until then, the developers have to manage with Move IR to make transaction modules and scripts.

Move IR is the compiler that compiles native scripts & modules right down to their bytecode portrayals. Although intelligible, it isn’t high level enough for an immediate translation into the Move bytecode.

Wrapping Up

With that much in store, we are yet to see how this new innovation called Facebook’s CryptoCurrency Libra will evolve cryptocurrency and blockchain app development services. Hopes are high but doubts seems to be higher.

Whether Facebook’s Digital Currency will be the next huge cryptographic money or a failure is difficult to say as of now. Facebook’s huge size, particularly in developing countries, may prepare individuals to give it a shot, especially if it can offer them the services they need. Next year, we’ll see whether Libra association will make or break it. Till then, sit back and relax.

Rate this article!

(3 ratings, average: 2.67 out of 5)

Join 60,000+ Subscribers

Get the weekly updates on the newest brand stories, business models and technology right in your inbox.

Humane yet subtle, Naiya is a girl full of ideas about almost everything. After earning a bachelor’s degree in computer science and engineering, she decided to merge her technical knowledge with her passion for writing – to accomplish something interesting with the fusion. Her write-ups are usually based on technology, mobile apps, and mobile development platforms to help people utilize the mobile world in an efficient way. Besides writing, you can find her making dance videos on Bollywood songs in a corner.

App Monetization Strategies: How to Make Money From an App?

Your app can draw revenue in many ways. All you need to figure out is suitable strategies that best fit your content, your audience, and your needs. This eGuide will put light on the same.

Download Now!Don't Know Much

About Technology?

Let our experts help you decide the right tech stack for your idea.